Why Cryptocurrency Scams Are Surging in 2024 and How You Can Stay Protected

Cryptocurrency scams are growing fast, leaving countless investors in financial ruins. With promises of quick profits and secret strategies, scammers take advantage of fear and greed. By knowing their tactics and how they operate, you can avoid falling victim. Whether it’s fake investment schemes or phishing attempts, staying alert is key. For example, understanding common refund scams can provide valuable insights to protect your assets. Awareness is your best tool against these sophisticated schemes. Stay informed, stay safe.

Understanding Cryptocurrency Scams

The rise of cryptocurrency has brought both opportunities and risks. While digital assets promise innovation, scammers exploit the lack of regulation and widespread interest. Knowing the most common scams and understanding alarming trends can help protect your assets and keep you ahead of fraudsters.

Types of Cryptocurrency Scams

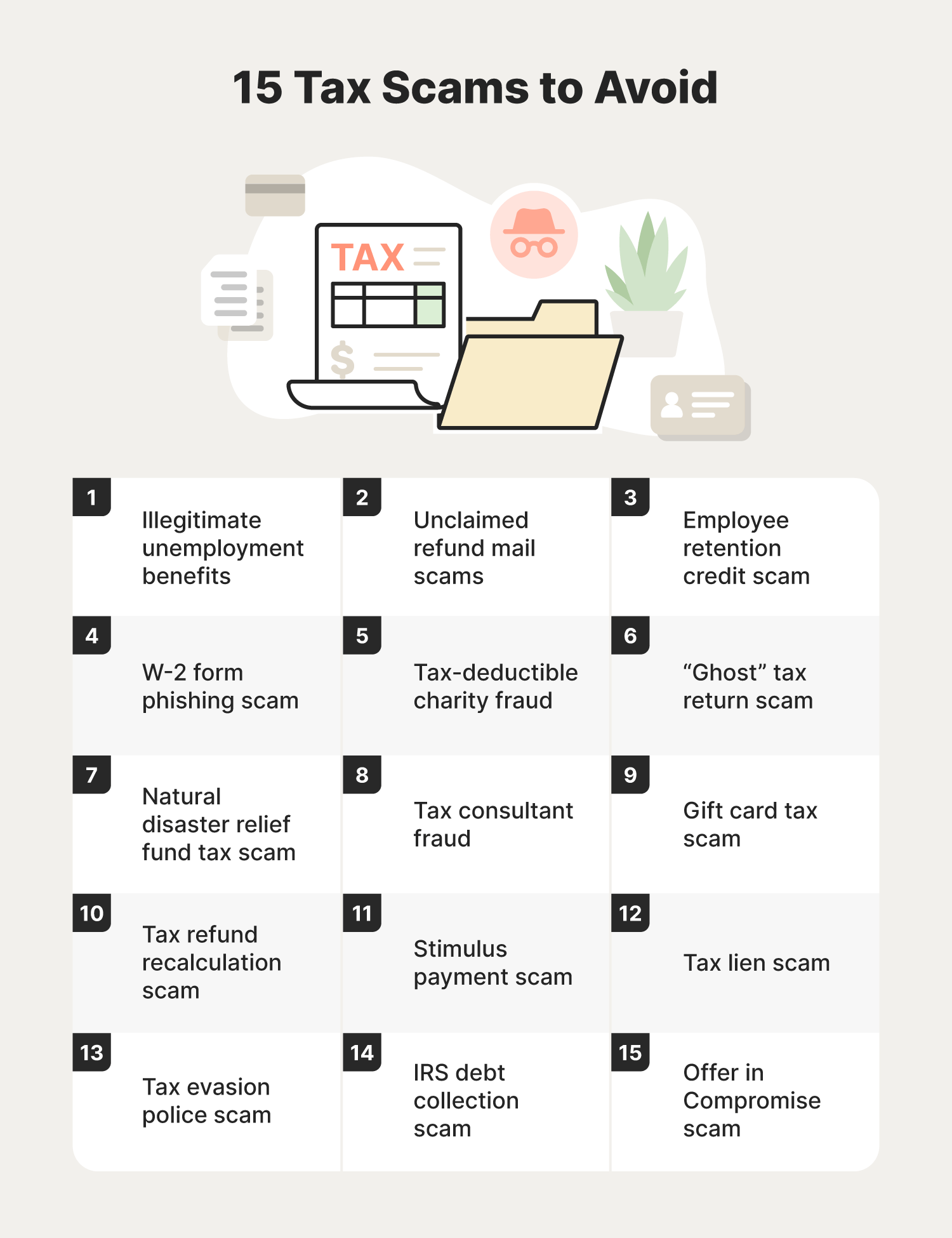

Scammers are constantly evolving their tactics to steal from unsuspecting individuals. Some of the most common scams include:

- Phishing Scams: These scams target users by impersonating legitimate companies or platforms. Fraudsters send fake emails, texts, or messages with malicious links, tricking victims into sharing sensitive information like wallet keys or login credentials.

- Ponzi Schemes: Similar to traditional Ponzi schemes, these scams promise high returns with little or no risk. Early investors may see some returns, but that money is often stolen from new participants. Eventually, the scheme collapses, leaving most people with massive losses.

- Fake Initial Coin Offerings (ICOs): Fake ICOs lure investors with the promise of cutting-edge projects. Scammers build realistic-looking websites and whitepapers to appear credible. Once they collect funds, they disappear without a trace.

- Bitcoin ATM Scams: Fraudsters instruct victims to deposit money into cryptocurrency ATMs as part of a fictitious investment or payment scheme. These ATMs make it hard to trace the funds.

Understanding these scams is your first line of defense. The scammers’ tactics are often convincing, preying on your emotions and making it essential to double-check every opportunity before committing.

For more tips on how to spot scams online, check out this guide.

Recent Statistics and Trends

As cryptocurrencies grow in popularity, so does the number of scams. Recent data highlights just how severe the problem has become:

- According to FTC data, Bitcoin ATM-related fraud topped $65 million in the first half of 2024 alone, a dramatic spike compared to last year.

- A report from Chainalysis revealed that scams accounted for billions of dollars in illicit crypto flows during 2024. Phishing attacks and Ponzi schemes continue to dominate.

- Over 50,000 investment scams were reported through mid-2024, costing victims nearly $2.5 billion, as outlined by The Motley Fool.

The trends are alarming and show no signs of slowing down. The combination of minimal regulations and the complexity of cryptocurrencies creates the perfect storm for fraud.

Stay vigilant, and stay safe—being proactive can save you from significant financial harm.

Why Cryptocurrency Scams Are Exploding

The cryptocurrency market has become a gold rush for both investors and scammers. With its rapid adoption and lack of safeguards, it’s no surprise scams are thriving. People are eager to invest in digital assets, but this enthusiasm has opened the door for fraud. To stay safe, it’s important to understand the factors driving this alarming trend.

Lack of Regulation

Cryptocurrency operates in a legal gray area, which makes it a breeding ground for scammers. Unlike traditional finance, there are no universal laws or regulations governing the crypto world. This means that fraudsters operate with little fear of repercussions.

For example, authorities can’t freeze assets or enforce compliance nearly as easily as they can with traditional banks. Scammers exploit this lack of oversight to pull off schemes like fake exchanges, phishing attacks, and Ponzi schemes. Even platforms claiming to be legitimate can take advantage of naive investors, as outlined in this analysis by CBS News.

Moreover, international transactions and blockchain anonymity make tracing stolen funds nearly impossible. The decentralized nature of cryptocurrencies puts most of the responsibility—and risk—onto the individual. Without robust safeguards, scams will continue to thrive in this environment.

Increased Popularity and Investment

Cryptocurrencies are booming, and with every surge in popularity comes a surge in fraud. The allure of cryptocurrency lies in its promise of high returns and financial independence. As more people learn about and invest in crypto, scammers see a bigger pool of potential victims.

Remember the early days of the gold rush? When everyone was chasing wealth, scammers were selling fake gold. The same is happening here. Scammers use enticing offers, fake endorsements, and even real influencers to lure investors. This has been particularly harmful to vulnerable groups like seniors, who have lost billions due to crypto fraud, as reported in this blog on elder fraud.

The crypto craze isn’t limited to seasoned investors. Beginners often fall for schemes like fake investment platforms or mining scams, thinking they’ve found the next big thing. Unfortunately, many are left empty-handed.

Social Media and Influencer Impact

Social media has amplified cryptocurrency scams in ways that were never possible before. Platforms like Twitter, Instagram, and TikTok are flooded with posts promising insane profits. Scammers create fake profiles, impersonate trusted figures, and even hack verified accounts to spread fraudulent schemes.

Influencers, intentionally or not, have played a damaging role by promoting questionable projects to their followers. When a crypto influencer endorses a project, it sparks trust and FOMO (fear of missing out). Scammers capitalize on this by spreading their schemes before victims can verify their legitimacy. For instance, fake airdrops and pump-and-dump schemes often gain traction through viral posts.

Misinformation spreads like wildfire on these platforms, making it easy for scammers to reach thousands, if not millions, of people. An FTC report highlighted this surge, warning users to be skeptical of get-rich-quick schemes shared online. You can read more on this issue in the FTC’s spotlight report.

Understanding these factors is crucial to protecting yourself in the volatile world of cryptocurrency. In the next section, we’ll discuss how to identify scams and what you can do to stay safe. Stay informed, and don’t let the promise of quick riches blind you to potential risks.

Recognizing the Signs of a Scam

Identifying a scam early can save you from devastating financial losses. Scammers are clever, using psychological tricks to disguise their schemes. However, understanding their methods makes it easier to protect yourself. Here’s how to spot suspicious activities before it’s too late.

Too Good to Be True Offers

One of the biggest red flags is the promise of extreme returns with little to no effort. Scammers lure victims by guaranteeing high profits, often sounding too good to pass up.

Here’s the truth: real investments carry risks, and no legitimate opportunity comes with a guaranteed return. Scammers exploit the natural desire for financial success, using phrases like “risk-free” or “guaranteed doubling of your money.” For instance, cryptocurrency scams often claim to have insider knowledge or exclusive software that ensures profits. These claims are not just improbable—they’re impossible.

Don’t let FOMO (“fear of missing out”) cloud your judgment. Always research offers thoroughly. For guidance, check out common online scams targeting freelancers to see how similar tactics are used in other fields.

Pressure Tactics

Scammers thrive on creating urgency. They’ll insist you act immediately—or risk losing out. Why? Because pressure forces rushed decisions, giving you little time to evaluate the situation.

Examples include:

- Countdown timers on sketchy investment websites.

- Phrases like “Act now! Limited spots available!”

- Fake “emergency” calls requesting cryptocurrency payments for alleged legal issues.

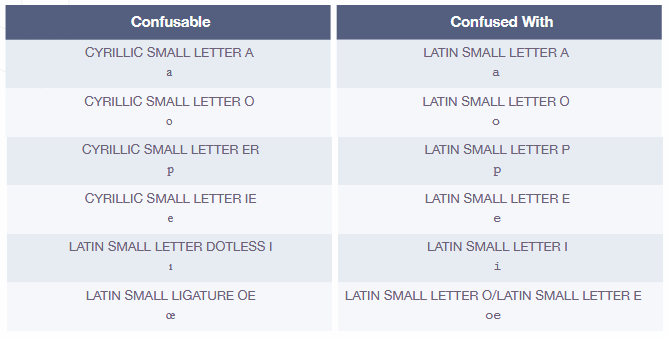

This sense of urgency can feel overwhelming. Always pause and consider: why the rush? If someone is pushing you to make a financial decision without allowing time for due diligence, it’s likely a scam. You can learn more about spotting suspicious web practices in this guide on Cyrillic homograph attacks.

Unprofessional Communication

Pay close attention to how scammers communicate. Sloppy grammar, misspellings, or unprofessional language are major warning signs. Legitimate organizations invest time and resources into clear, professional messaging.

Scams often involve:

- Emails or texts with odd phrasing.

- Fake business correspondence that lacks proper formatting.

- Messages riddled with typos or incoherent sentences.

For example, phishing attempts frequently use official-looking emails to trick users into sharing personal details. However, subtle errors are often giveaways. If anything feels off, it probably is. The Federal Trade Commission lists poor communication as one of the top indicators of fraud.

Always trust your instincts. If something feels unprofessional, take a step back and verify its authenticity through legitimate channels.

How to Stay Safe from Cryptocurrency Scams

Protecting yourself from cryptocurrency scams requires vigilance, knowledge, and the right tools. With scams evolving as rapidly as the digital assets themselves, it’s essential to stay one step ahead. Here’s how you can secure your investments and minimize risks.

Research Before Investing

Before you invest in any cryptocurrency project, take the time to research thoroughly. Scammers prey on naivety and FOMO (fear of missing out), so make it a habit to investigate every claim. Ask yourself:

- Who is behind the project? Research the team.

- Does the project have a whitepaper? Is it professional and credible?

- What are other investors saying? Check reviews and forums.

Avoid making decisions based solely on what you see on social media or through unsolicited messages. If a project lacks transparency or has unverifiable claims, it’s likely fraudulent. For more tips on identifying red flags, explore this guide on spotting suspicious scams.

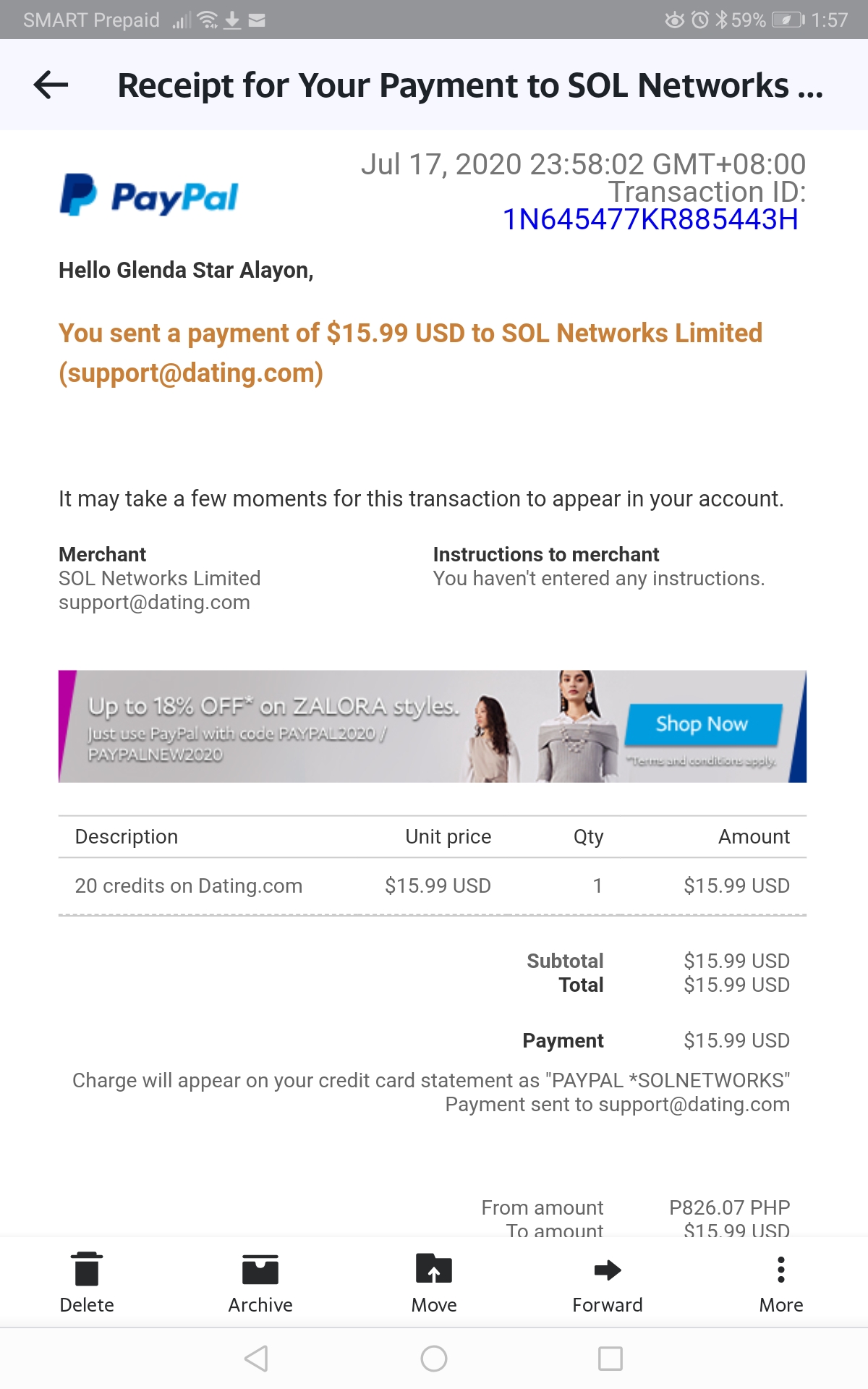

Use Secure Payment Methods

When dealing with cryptocurrencies, always use secure and reliable platforms. Avoid making payments to unknown addresses or engaging in off-the-grid transactions. Trustworthy platforms have:

- Encryption to protect your information.

- Verified reviews and a strong online presence.

- 24/7 customer support to resolve issues.

Never send payments through unfamiliar apps or unverified services. Many scams involve convincing victims to transfer funds to third-party wallets, making it impossible to recover your money. Learn more about protecting yourself from suspicious payment schemes by reading these tips.

Enable Two-Factor Authentication

Two-factor authentication (2FA) adds an extra layer of security to your accounts. It’s one of the easiest yet most effective ways to protect your investments from being hacked. Most reputable platforms support 2FA through:

- SMS codes.

- Authenticator apps like Google Authenticator or Authy.

- Biometric verification (fingerprint or facial recognition).

Make sure to enable 2FA on all accounts linked to your cryptocurrency. Without it, even the best passwords can be bypassed by phishing or brute-force attacks.

Educate Yourself Continuously

Scammers continuously adapt their techniques. Staying informed about the latest scams and security practices is key to protecting yourself. Follow cryptocurrency news outlets and reputable blogs for updates. Some useful resources include:

- Online security guides.

- Fraud prevention workshops.

- Dedicated forums and communities that discuss cryptocurrency.

You can also check out articles on recent scam trends, like this detailed prevention guide, to stay ahead of fraudsters.

Report Scams

If you fall victim to a scam or notice suspicious activities, report it immediately. Reporting not only helps you, but it also prevents others from being targeted. Many organizations and websites allow you to submit complaints and share warnings. For example:

- Contact local law enforcement.

- Report to platforms like the FTC Consumer Center.

- Use fraud reporting websites like LegitPit—see this detailed analysis of refund scams.

Taking action against scammers ensures they have fewer chances to exploit others. Together, we can create a safer environment for everyone navigating the world of crypto.

Conclusion

Cryptocurrency scams are a growing menace that prey on trust and ambition. These scams exploit the fast-paced world of digital investments, misleading millions through deceitful tactics. Staying vigilant and informed is the best way to protect yourself.

Why Scams Are Rising Rapidly

The lack of regulation in cryptocurrency markets allows bad actors to operate freely. Unlike traditional finance, there are few legal hurdles for fraudsters to overcome. Blockchain’s anonymity also makes tracking stolen funds difficult, giving scammers an advantage that wouldn’t exist in conventional banking.

The popularity of cryptocurrencies only adds fuel to the fire. As more people flock to invest, it creates a fertile ground for scammers. Social media amplifies these schemes, spreading deception at a scale never seen before.

For further insights into why these scams persist, check out this expert breakdown from Morgan Stanley.

How You Can Stay Protected

Awareness of common tactics used by scammers is essential. Simple steps like enabling two-factor authentication, researching projects thoroughly, and avoiding unsolicited investment offers can save you from severe losses. Most importantly, take the time to educate yourself continuously. Scams evolve, and staying ahead requires constant vigilance.

Additionally, familiarize yourself with security basics. For instance, phishing emails and fake websites often have subtle signs that indicate fraud. Always double-check URLs and avoid oversharing personal or financial details online.

For actionable strategies to safeguard your crypto assets, this comprehensive guide is worth a read.

Remember, no investment is without risk—if something sounds too good to be true, it probably is. Prevention is the most effective defense in the ever-changing landscape of cryptocurrency fraud.